Micro Focus Account Management. Great Relationships. Great Teams.

I am Dr. James D. Borderick, and I look after the Competitive Benchmark research for Micro Focus, which I have been doing for over five years. I wish to share some very interesting statistics with our followers regarding satisfaction with Account Management.

How do we Measure Account Management?

Micro Focus uses double-blind competitive benchmarking to gauge how well we are doing against the competition. This strategy means we can understand how we are performing with a high degree of statistical accuracy using a highly repeatable and scientific method. There are several customer lifecycle touchpoints and brand image attributes that are tracked, and Account Management is one of them.

What is Account Management?

Account Management has an industry definition of “Your relationship with account leaders and account teams” and helps to ensure that customers gain as much use and value as possible out of their purchase. The business reasoning behind Account Management is that it can contribute to brand loyalty and repeat sales; happier customers tend to create repeat customers. Good Account Management can result in positive word-of-mouth for a company. Poor Account Management can prevent companies from achieving a good customer satisfaction.

What is the Relative Impact of Account Management on Net Promoter®?

Micro Focus, via Competitive Benchmarking, also know that the Account Management touchpoint provides 6.9% of the relative impact on Net Promoter® or the relationship metric. This is important to realise since all touchpoints contribute in some way to the overall ‘relationship’ metric with a company, and thus, using the right metric at the right time is not only important, but necessary (but that’s a topic for another time).

So how is Micro Focus performing against the competition in Account Management?

Micro Focus Account Management Performance Against the Competition

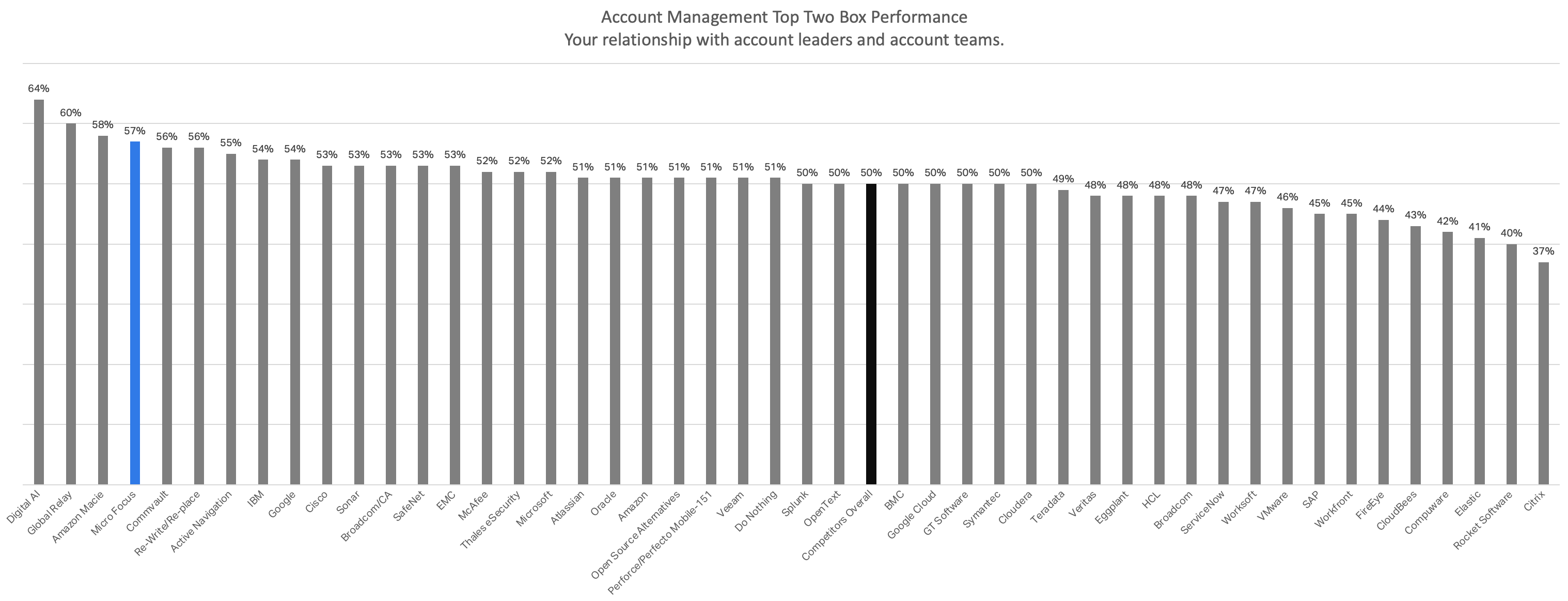

The figure above presents the latest Account Management top-two box satisfaction for each brand* at the worldwide level in software. This percentage shows the number of customers responding with the top scores. A way of interpreting this for a value of 50%, then 1 in 2 of customers liked the Account Management and 1 in 2 didn’t like it. Generally, then all software companies are not that great at Account Management (average is 50% top-two box satisfaction) and so for Micro Focus to be fourth in the industry is a great feat indeed. Micro Focus Account Management is 7% better than the average competitor in the industry and is 4th out of all competitors with a top-two box satisfaction of 57%. When we compare against some of our competitors, we see that we are 3% better than IBM, 5% better than Microsoft, 6% better than Amazon, 7% better than Splunk, 10% better than ServiceNow, and 11% better than VMware.

*Sample Size Worldwide: n=15,807, Micro Focus n=1,407, and all competitors n=14,400.

Why is the Competitive Benchmark industry defensible?

We do not know who the respondents are, and they themselves do not know that Micro Focus is sponsoring the study, thus this study has a dramatically lower bias than other surveys. We can safely say that the data analytics is performed at the 90% Confidence Level, which is unheard of in the industry. This means if any of our competitors performed the same study, they would have the same results. Couple these points with a data sample size of over 15,000 respondents per rolling quarter and we have a Benchmark that truly is industry defensible.

Don’t hesitate to contact me on Twitter to talk directly if you’d like, especially if you have suggestions for how the teams at Micro Focus could improve their Account Management further!

This post was first first published on Home | Micro Focus Blog website by DrBorderick. You can view it by clicking here